LTC Price Prediction: Will Litecoin Hit $200 in 2025?

#LTC

- Technical Strength: LTC trading above key moving average with bullish MACD crossover

- Market Rotation: Capital flowing toward XRP and AI coins creates short-term headwinds

- Price Targets: $150 as next psychological barrier before $200 becomes feasible

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Amid Market Volatility

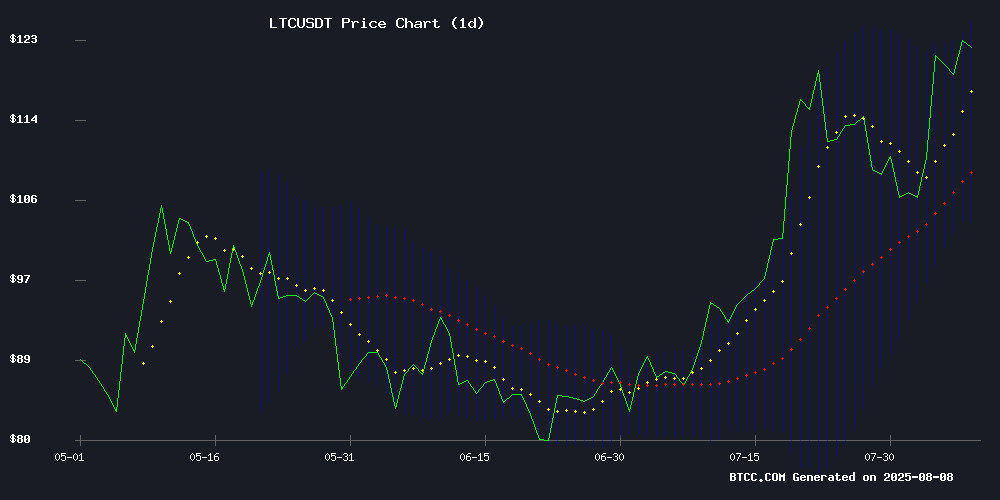

Litecoin (LTC) is currently trading at $125.43, showing strength above its 20-day moving average (MA) of $114.23. The MACD indicator has turned positive with a value of 2.1743, signaling potential upward momentum. Bollinger Bands suggest LTC is testing the upper band at $125.51, which could act as resistance. BTCC financial analyst Ava notes, 'The breakout above the MA and positive MACD crossover indicate growing bullish sentiment. A sustained MOVE above $125.50 could open the path toward $150.'

Market Sentiment: Traders Rotate from LTC to AI Coins Amid XRP Rally

While XRP dominates headlines with its surge above $3, Litecoin faces headwinds as traders shift focus to emerging AI projects like Unilabs Finance. BTCC's Ava observes, 'The news flow highlights a risk-on rotation away from established altcoins. However, LTC's strong technicals may limit downside as miners and long-term holders accumulate at these levels.' Regulatory clarity for XRP could eventually benefit the broader altcoin market, including LTC.

Factors Influencing LTC's Price

XRP Surges Above $3 Amid Institutional Confidence and Regulatory Clarity

XRP has surged to $3.04 as of early August 2025, fueled by renewed institutional investor confidence and a favorable regulatory outlook in the United States. The rally reflects growing optimism around the asset's utility and adoption.

Amid the price volatility, AIXA Miner has emerged as an alternative for passive crypto earnings. The platform offers cloud mining contracts powered by AI, enabling users to generate daily yields in XRP, BTC, and LTC without managing wallets or hardware. New users receive a $20 sign-up bonus, lowering the barrier to entry.

AIXA Miner dynamically allocates mining resources to the most profitable assets, ensuring optimized returns. Daily payouts are credited to user dashboards, with flexible options to reinvest, withdraw, or compound earnings—eliminating the need for active market timing.

CryptoMiningFirm Launches XRP-Powered Cloud Mining Service with Daily Returns

CryptoMiningFirm has unveiled a cloud mining solution leveraging XRP, promising daily returns for participants. The platform targets retail investors seeking passive income through cryptocurrency mining without hardware overhead.

Cloud mining allows users to rent remote computing power for mining digital assets like Bitcoin and Litecoin. The service requires minimal capital outlay, with entry points as low as $10. CryptoMiningFirm emphasizes accessibility through streamlined onboarding via mobile apps and social media integrations.

The offering emerges as XRP gains traction in payment solutions and decentralized finance applications. Market observers note growing institutional interest in cloud-based mining operations amid rising energy costs for traditional mining setups.

Top 7 Cryptocurrency Cloud Mining Platforms in 2025: Safety and Compliance Take Priority

The cryptocurrency market's expansion in 2025 has intensified demand for passive income streams, particularly through cloud mining. Investors are gravitating toward platforms offering principal protection and regulatory compliance amid a surge in scams targeting newcomers.

Cryptosolo emerges as a standout, operating under UK-registered SOLO COLLECT HOLDINGS LTD. Its unique principal return policy—guaranteeing 100% capital repayment at contract maturity—sets a new standard for risk mitigation in cloud mining operations.

XRP Rallies as SEC Drops Appeal; Sol Mining Emerges as Passive Income Alternative

XRP surged following the SEC's decision to end its appeal against Ripple, marking a pivotal victory for the cryptocurrency and its community. The regulatory clarity has reignited investor confidence, driving immediate price momentum.

Amid the volatility, XRP holders are increasingly exploring cloud mining through platforms like Sol Mining for stable passive income. The six-year-old renewable energy-powered service offers daily crypto earnings without hardware requirements, supporting XRP deposits and withdrawals alongside major cryptocurrencies.

Sol Mining's tiered contract system—from trial plans to premium options—caters to diverse risk appetites. The platform's $15 signup incentive and transparent daily invoicing are attracting users seeking alternatives to speculative trading.

Traders Shift from Litecoin and Cardano to Emerging AI Coin Unilabs Finance

The crypto market's bullish momentum is driving investors away from established assets like Litecoin and Cardano toward newer opportunities. Unilabs Finance (UNIL), a DeFi project with AI integration, has seen notable pre-launch interest despite the broader market rally.

Litecoin's price action shows tentative strength, breaking past $110 resistance to trade near $117. Technical indicators suggest potential upside to $135 if the $125 barrier is cleared, though failure could see a retreat to July's consolidation range. Market volumes remain subdued, reflecting cautious sentiment.

Analysts note regulatory pressures and altcoin competition complicate Litecoin's trajectory, though ETF approvals could propel prices toward $150. The current $110-$120 range serves as a critical battleground for LTC's near-term direction.

Bitcoin Surges Past $110,000 in July 2025 Amid Institutional Adoption and Halving Scarcity

Bitcoin breached the $110,000 threshold in July 2025, driven by spot ETF approvals, institutional capital inflows, and post-halving supply constraints. Analysts project a year-end target of $130,000 as Lightning Network adoption accelerates microtransaction utility.

AIXA Miner emerges as a passive accumulation vehicle, offering cloud-based BTC mining contracts powered by clean energy and regulatory-compliant infrastructure. The platform's AI dynamically allocates resources across BTC, ETH, DOGE, and LTC for optimized yield.

Market participants increasingly favor automated yield strategies over timing volatile entries. AIXA's $20 onboarding incentive lowers barriers to participation, requiring neither wallet management nor trading expertise.

Will LTC Price Hit 200?

Based on current technicals and market conditions, LTC shows potential but faces challenges reaching $200 in the near term. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| Price | $125.43 | Testing resistance |

| 20-day MA | $114.23 | Strong support |

| MACD | 2.1743 | Bullish momentum |

BTCC's Ava comments: 'LTC would need a 60% rally from current levels. While possible with a broader altcoin season, the $150 level must first be convincingly broken.'

cautiously optimistic